CryptoCurrency Security Standard (CCSS) Updated to Version 9.0

Focused on private key management, this critical update stands to strengthen security across the crypto industry and is strongly recommended for adoption

Version 9.0 of the CryptoCurrency Security Standard (CCSS) has been published! The Standard is a vital framework designed to safeguard cryptocurrency systems, particularly in the area of private key management. With the rise of high-profile hacks targeting private keys, the necessity of a rigorous, community-driven standard is more pressing than ever.

Since its initial release in 2015, the CCSS has been developed and maintained through community collaboration, ensuring it remains free from corporate ownership or control. This neutrality ensures that updates, including the latest 9.0 release, focus entirely on enhancing the security of the cryptocurrency ecosystem.

“As part of the update project for CCSS version 9.0, the CCSS Steering Committee launched a stakeholder's feedback program encouraging the community to review the draft CCSS version and provide suggestions. The response exceeded expectations, and many suggestions were incorporated into Version 9.0. This is where community-driven standards excel by leveraging the vast skill and experience in the community.” said Marc Krisjanous, Associate Director of SixBlocks Audit and a member of the C4 Steering Committee.

The Importance of Private Key Management

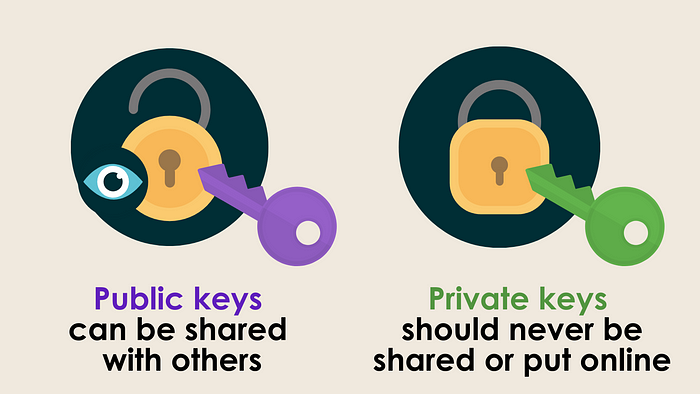

Private keys are the cornerstone of cryptocurrency security. The loss or theft of a private key can lead to catastrophic and permanent financial damage. Despite advancements in blockchain technology, improper private key management—whether through weak storage practices, unauthorized access, or insecure custodial solutions—continues to result in significant breaches. These incidents have cost the cryptocurrency community billions of dollars and undermined public confidence in the safety of digital assets.

"Private key management is critical to the survival and growth of the cryptocurrency industry," said Jessica Levesque, Executive Director at C4. "The release of CCSS Version 9.0 demonstrates the importance of keeping security standards up to date. When private keys are compromised, the consequences are irreversible, making it essential that our community of experts continually refines best practices for managing these keys."

CCSS Steering Committee Chair S. Dirk Anderson added, "Because no company controls the CCSS, the focus is always on the long-term security of the entire ecosystem, rather than on protecting specific corporate interests. This ensures the standard reflects the needs of the industry as a whole."

Key Updates to CCSS Version 9.0:

- Enhancement and clarification of existing requirements wording, including consolidation of the terminology used, replacement of terms and statements that restrict the use of new technologies, and more clarity on referencing external standards, making CCSS easier to understand and implement.

- New requirements addressing emerging security challenges within decentralized finance (DeFi) and other blockchain-based technical components, such as smart contracts, which introduce more complex key management systems.

- New governance requirements include written acknowledgements from executive management and key custodians, risk management, threat modeling, and service provider management.

- Enhancement of the logging aspect by adding monitoring requirements to ensure log event records are collected and monitored for suspicious activity, and (2) wallet addresses receive the same scrutiny.

- Support for single-signer mechanisms. Though not considered best practice, single-signer mechanisms are used in many architectures. The latest CCSS update provides detailed considerations when evaluating the use of a single-signer mechanism.

- New requirements addressing physical security controls within environments where key management activities are conducted.

- New requirement for training for personnel involved in key management operations and personnel who could impact the security of the key management system.

The updated Standard can be found in our CCSS v9.0 Matrix.

An overview of updates can be found in our summary of changes document.

A Continued Focus on Community Leadership

The CCSS Steering Committee, composed of leading security experts and blockchain technology professionals from around the globe, oversees each update to ensure the Standard remains relevant in the face of new threats. Importantly, no corporations pay to participate in the creation or update of the standard, allowing the committee to maintain its focus solely on improving the security of the cryptocurrency industry.

"The collaborative nature of the CCSS is key to its ongoing success," said Jameson Lopp, Co-founder and Chief Security Officer of Casa, and a C4 Steering Committee Member. "Because the people contributing to the standard have no vested interest in promoting any particular company or product, the standard remains an objective measure of security best practices."

As the cryptocurrency industry continues to evolve, security must evolve with it. The CCSS plays a vital role in protecting the assets and trust of users, ensuring that as the industry grows, it remains safe for adoption on a global scale.

How to Get Involved

Contributing to the development of the CCSS is open to anyone and free of charge. Blockchain developers, security professionals, and cryptocurrency enthusiasts are encouraged to join the effort to secure the future of cryptocurrency.

For more information about the CCSS or to learn about certification opportunities, please visit cryptoconsortium.org.

About C4

The CryptoCurrency Certification Consortium (C4) is a nonprofit organization dedicated to establishing and maintaining security standards for the cryptocurrency industry. Through education, certification programs, and community collaboration, C4 works to ensure the responsible use and secure development of blockchain technology. Visit the website, follow C4 on LinkedIn, or “Subscribe” on YouTube.

Media Contact: Info@cryptoconsortium.org

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

Announcing the New Chair of the CCSS Committee: S. Dirk Anderson

The CryptoCurrency Certification Consortium (C4) is thrilled to announce that S. Dirk Anderson, CRISC, CISA, CBP, has been appointed as the new Chair of the CryptoCurrency Security Standard (CCSS) Committee. Dirk will be taking over from Petri Basson who has led the committee since August of 2019. This milestone marks the next chapter in C4’s mission to establish and promote security best practices for cryptocurrency systems.

A Legacy of Leadership

S. Dirk Anderson is no stranger to C4 and its community. Having served as the chair of the Certified Bitcoin Professional (CBP) committee since 2019 Dirk has demonstrated his ability to foster collaboration, drive innovation, and maintain the highest standards of excellence. For the past five years, he has also been a key member of the CCSS committee, contributing his expertise and helping shape the CCSS into what it is today.

Dirk is currently the founder of the Imagine Crypto consultancy before which he was the Chief Operating Officer at SALT Lending. As a cryptocurrency, technology, and cyber risk professional with over three decades of experience, Dirk has a proven track record of addressing the unique challenges of blockchain technology. His insights have been instrumental in ensuring the CCSS, which was first published in 2014, is regularly updated and remains relevant in an ever-evolving crypto landscape.

The Importance of the CCSS

The CryptoCurrency Security Standard (CCSS) is the industry's benchmark for assessing the key management security of cryptocurrency systems. It provides clear requirements and best practices for securing keys, wallets, exchanges, and other critical components of the blockchain ecosystem. With increasing threats to digital assets, the CCSS is more relevant than ever in ensuring confidence and trust in cryptocurrency systems worldwide.

“Security is the foundation of trust in the cryptocurrency ecosystem,” Dirk said in a recent interview. “The CCSS plays a critical role in setting the bar for how digital assets should be safeguarded. As adoption grows, so too does the responsibility to ensure the tools and systems we use are secure and resilient.”

“The CCSS is more than just a set of guidelines—it’s a vital framework for building trust and security in the cryptocurrency space,” Dirk said. “I’m honored to take on this role and continue the incredible work Petri Basson and the committee have accomplished. As the industry evolves, so must the CCSS, ensuring we remain at the forefront of safeguarding digital assets.”

C4’s executive director, Jessica Levesque, shared her confidence in Dirk’s leadership, saying, “Dirk has demonstrated exceptional dedication and vision throughout his time with C4. His expertise and passion for advancing cryptocurrency security will ensure the CCSS remains a critical resource for organizations worldwide. We are thrilled to have him as the new Chair.”

A Vision for the Future

As the new chair, Dirk is committed to expanding the CCSS’s reach and impact. His vision includes greater adoption of the standard by organizations worldwide, as well as continued collaboration with industry experts to ensure the CCSS evolves alongside technological advancements.

“One of the greatest strengths of the CCSS is its ability to bring together professionals from diverse backgrounds to solve complex security challenges,” Dirk remarked. “I’m honored to lead this committee and work with such a talented group of individuals to advance the standard.”

A Note of Thanks

C4 would like to extend its deepest gratitude to the previous committee chair, Petri Basson, for his dedication and contributions. Petri’s work has laid a strong foundation upon which Dirk and the committee will continue to build and he will be staying on as a member of the steering committee.

Join Us in Congratulating Dirk

Please join us in congratulating Dirk Anderson on his new role as Chair of the CCSS Committee. Under his leadership, we are confident that the CCSS will continue to set the global standard for cryptocurrency security.

To learn more about the CCSS or get involved, visit C4's website.

Feel free to share this announcement and celebrate the next chapter for the CCSS and the incredible team driving it forward. Together, we can build a safer and more secure blockchain future.

C4 Welcomes Rodney MacInnes as New CBP Committee Chair

The CryptoCurrency Certification Consortium (C4) is pleased to announce Rodney MacInnes as the new Chair of the Certified Bitcoin Professional (CBP) Committee. Rodney brings five years of dedicated service to the CBP Committee and a wealth of professional expertise from his role as CRO and AML Compliance Ninja at Outlier Compliance Group. His leadership will usher in an exciting new chapter for the program.

Released in 2014, alongside C4’s inception, the CBP was the first certification of its kind, setting the standard for Bitcoin proficiency worldwide. Over the years, the program has been continually updated to ensure it remains current, relevant and valuable as the Bitcoin landscape evolves. With thousands of Certified Bitcoin Professionals globally, the CBP equips individuals with the knowledge and credibility needed to navigate and contribute responsibly to the Bitcoin ecosystem.

Rodney reflected on his new role: "Bitcoin’s relevance has never been greater, and the need for trusted education and proof of knowledge is critical. I’m honored to lead the CBP Committee as we continue to provide professionals and organizations with the tools to engage with Bitcoin responsibly. The CBP is a symbol of trust and competence in the crypto industry."

S. Dirk Anderson, the outgoing CBP Chair, expressed confidence in Rodney’s ability to elevate the program further: "Rodney has been an invaluable member of the CBP Committee for years. His vision and expertise are exactly what the program needs to stay ahead of the curve and continue driving meaningful impact."

C4 and the CBP Committee offer a robust prep course and prep book to help candidates succeed, and the certification itself demonstrates a foundational understanding of Bitcoin’s principles, operations, and security. Additionally, the CBP Committee regularly conducts livestreams for free educational events, making unbiased, accessible education available to the wider community. This is only possible because of the dedicated committee members who bring deep expertise, keep up with the ever-evolving technology, and ensure the content remains relevant and valuable. With members from diverse professional backgrounds, the committee ensures a well-rounded, impartial approach to Bitcoin education.

Hunter Albright, a fellow CBP Committee member, shared his excitement about Rodney’s new role: "Rodney’s experience and commitment to C4 make him the perfect choice for Chair for the CBP committee. Working on this committee has been both rewarding and enjoyable—we’re a team that takes the mission seriously but also knows how to have fun while doing meaningful work."

Jessica Levesque, Executive Director of C4, highlighted the program’s impact: "Bitcoin education is hard to find without bias, and that’s where the CBP stands out. It’s a trusted resource that brings together insights from a variety of experts. Rodney’s leadership will ensure the CBP continues to thrive as the go-to certification for Bitcoin professionals."

The CBP program remains a cornerstone of C4’s mission to advance knowledge and professionalism in cryptocurrency. With Rodney MacInnes at the helm, supported by a passionate and diverse committee, the future of the CBP is brighter than ever. Stay tuned for upcoming educational events and updates as Rodney and the CBP Committee continue to lead the way!

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

Crypto Compromise – Data Breaches and Security Scenarios

Overview

Unfortunately, data breaches happen. Any company, service, or piece of software may experience compromise at some point. Engineering secure software is a difficult challenge despite the best efforts of developers, and hackers continue to evolve their tactics. But what happens when there is a data breach, and what are some ways that an attacker can use stolen data to steal valuable information or even money? In this article, we’ll discuss two examples of data breaches that affect the cryptocurrency world in particular. We will discuss what kind of data can be stolen, how the compromise can affect users, and what individuals can do to mitigate those effects on their security and privacy.

Password Manager Breaches and Crypto Theft

The first breach in our list is that of LastPass, a cloud password manager. LastPass (and other password managers) allow users to securely store, generate, and autofill passwords and other secrets for various services. The user specifies a master passphrase that only they know, which is used as a key to encrypt the password vault using strong encryption. In order to access the secrets inside, a user must specify that master passphrase to decrypt the data inside.

This allows users to store lots of long, strong, randomly generated passphrases that a user could not remember on their own. A password manager is an excellent security tool for this reason, as it prevents password reuse and allows the use of stronger passphrases. However, the security of the master passphrase is critically important. If the vault uses strong, properly implemented encryption such as AES, the only way for an attacker to gain access to the data inside is to guess the password.

In August of 2022, LastPass experienced a breach where the encrypted vaults were stolen from LastPass. LastPass and other password manager companies don’t know or store your master passphrase, just the encrypted vaults. The attackers now have snapshots of those vaults from the time of compromise. But what does that mean for users? In order to gain access to the secrets stored inside, the attackers must try to crack the password using something like a brute- force or dictionary attack. This does take a lot of computing resources, but in some cases is quite worth the reward.

Unfortunately, some users did not use the best master passphrases possible. Those compromised vaults, in some cases, contained a juicy reward for the attackers – cryptocurrency seed phrases! Some users of LastPass that stored seed phrases in their vaults have had their cryptocurrency stolen as a result, as anyone that has the seed has access to the coins. A BIP39 passphrase, preferably not stored online or not stored with the seed, could have added an additional layer of protection.

It is absolutely critical that users of any password manager generate a very long, strong, high entropy passphrase to protect their vault. The master passphrase, in this case, is the weakest link in the chain. Compromise the passphrase, compromise the vault and all the secrets inside. It’s also important if you’re the victim of such a breach to be proactive. Move your secrets to a new platform, rotate the secrets (seed phrases, passwords, etc.) to new ones, and choose a new master passphrase. Active management of your data can mitigate the effects of such a compromise.

Crypto Company Email Leaks

Another, perhaps more straightforward data breach to understand occurred with CoinMarketCap, a cryptocurrency market information platform. The emails of over 3 million users were exposed – no passwords, just emails. It might seem that this is a relatively tame breach, as the attackers cannot directly crack and takeover accounts without a password breach.

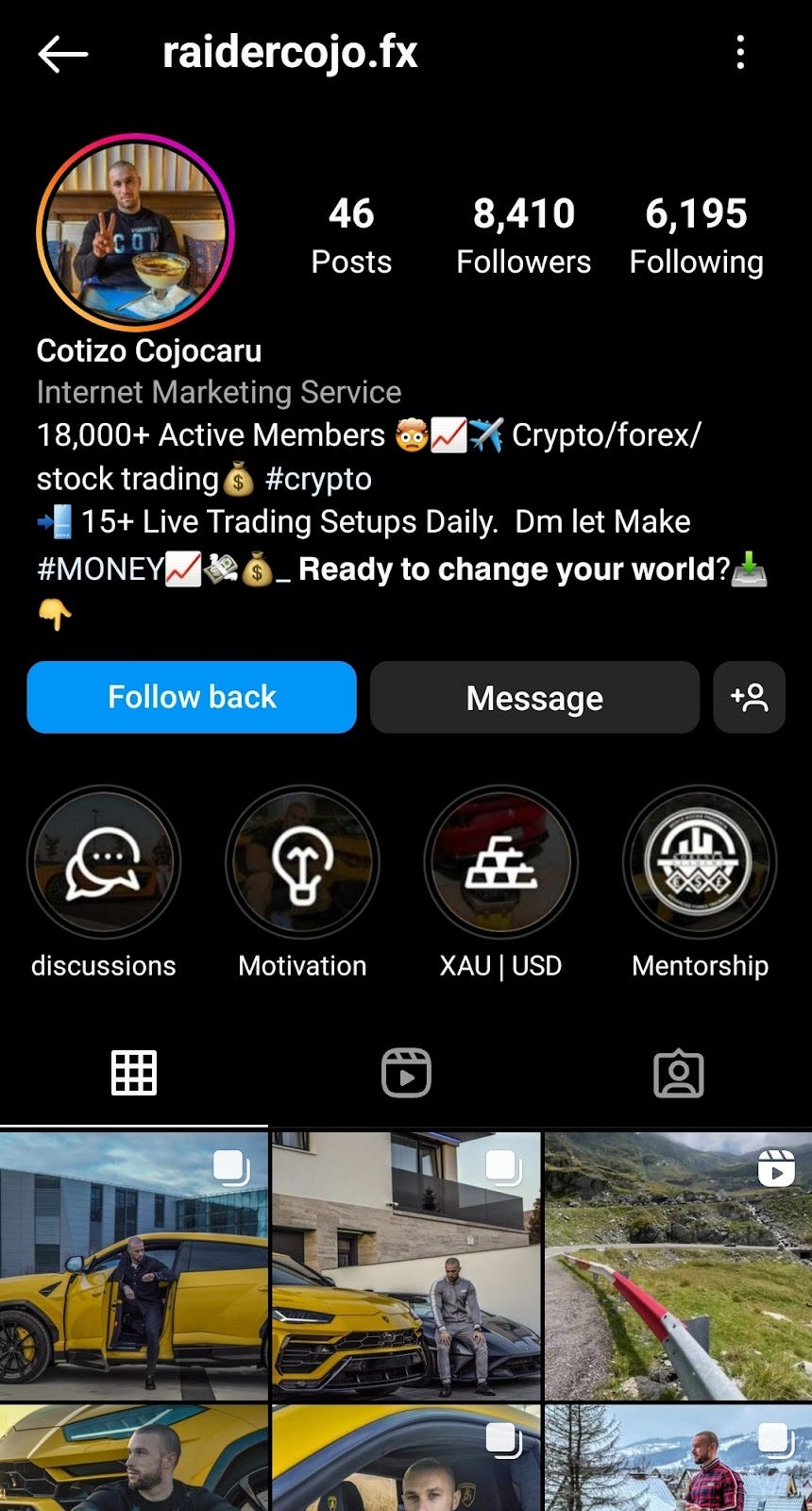

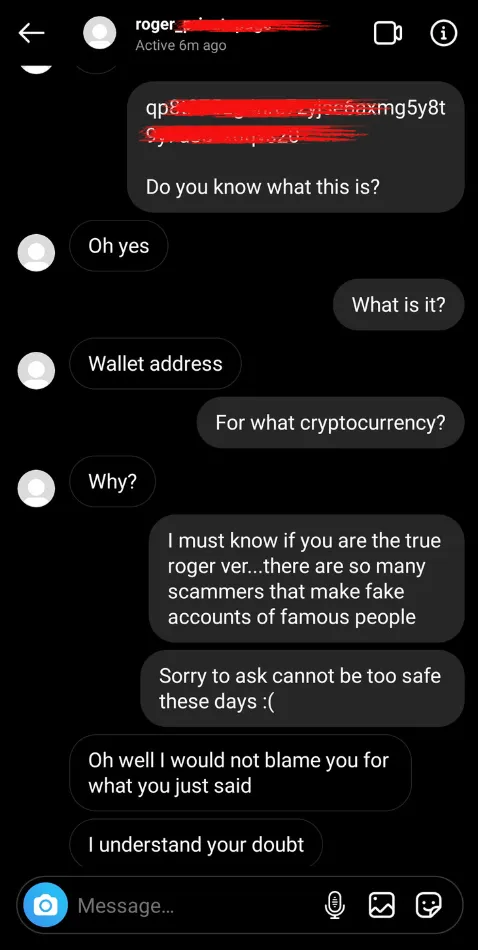

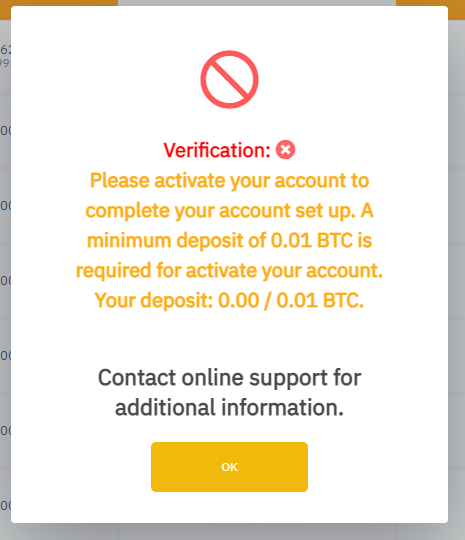

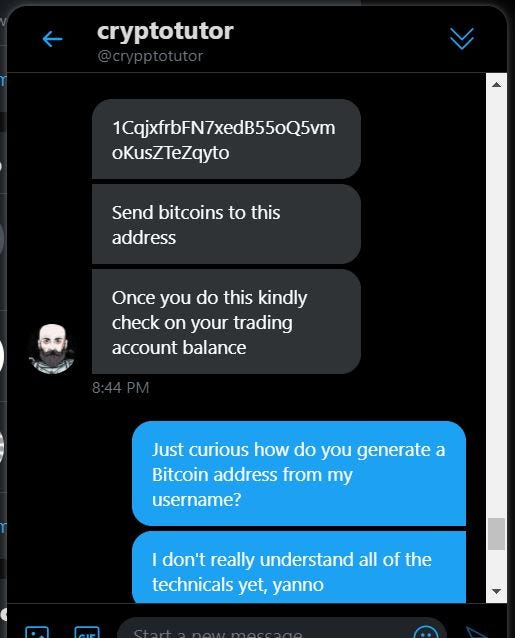

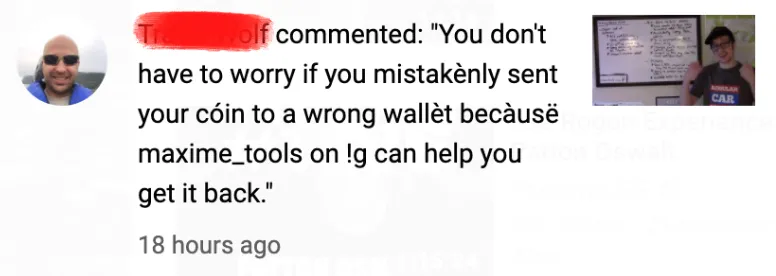

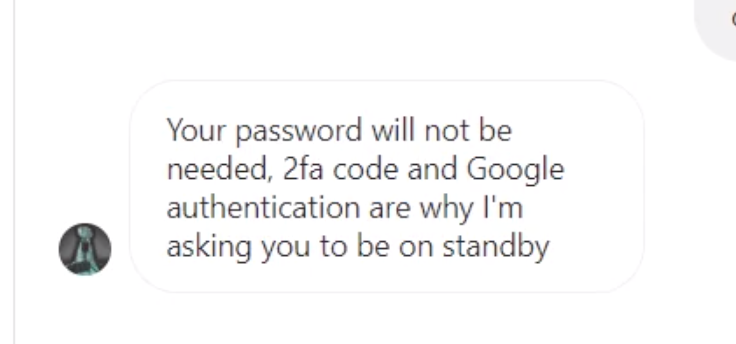

However, emails allow a common vector of attack to flourish – phishing. One of the most effective ways for an attacker to compromise a user account isn’t technical, it’s human. Phishing is the act of tricking a user into giving up information that they shouldn’t such as a password or a crypto seed phrase. If your email is included in a data breach such as CoinMarketCap’s, it tells hackers something about you – that you use or are interested in cryptocurrency.

As such, attackers have used emails in this breach to send out all sorts of crypto-related phishing emails – pretending to be CoinMarketCap, Coinbase, Gemini, Metamask, and other crypto services, coins, airdrops, and more. Victims of this breach have been targeted with these wide-ranging phishing emails in the hope that users inadvertently give up a seed phrase, a password, or sign a malicious contract. In this case, it’s critical that users have awareness about phishing. Users should know what to look for when it comes to phishing – a sense of urgency, a too good to be true offer, coming from a different email than expected, and more. Again, active awareness and self-education is a key to preventing compromise.

Awareness and Activity

Breaches happen in the digital world, and crypto-related breaches can be particularly devastating as they have financial consequences. Two examples include the breach of password managers containing seed phrases or exchange credentials, and email breaches that make users the target of sophisticated phishing attacks. In both cases, active awareness is important for user security. Taking the time to educate oneself about phishing may prevent falling victim to theft. If a user knows they’ve been compromised in a password manager breach, taking the time to rotate credentials and choose a new master passphrase on an immediate basis, can help avoid loss.

This article was written by our CryptoCurrency Essentials (CCE) Committee, with special thanks to committee member Josh McIntyre.

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

MultiSig Wallets & Addresses: How They Work and Their Role in Crypto Security

Multi-signature (Multi-Sig) wallets use a security mechanism where multiple keys are required to authorize a cryptocurrency transaction. This added layer of protection makes Multi-Sig wallets a popular choice for both institutional and retail investors. However, the increased security comes with added complexity, so it's important to understand the risks before using them.

Multi-Sig Explained

In the world of cryptocurrency, the adage "not your keys, not your coins" still holds true. Securing your private keys is crucial, and one of the key methods is through a Multi-Sig wallet. A Multi-Sig wallet requires multiple cryptographic keys, and a threshold number of these keys must be used to authorize a transaction (tx). By eliminating the reliance on a single key, Multi-Sig wallets significantly reduce the risk of fraud, as no single person can complete a transaction alone.

Types of Multi-Sig

There are two main types of Multi-Sig implementations:

Pure Multi-Sig (Different Private Keys)

This type uses different private keys for each holder. For example, in a 2-of-3 setup, there are three private key holders, and at least two of them must sign the transaction for it to be approved. This approach is particularly suited for institutional users who require a high level of security and accountability.

Two-Factor Authentication (2FA, Same Private Key)

In this setup, a single private key is used, but it's distributed across multiple devices (e.g., laptop, phone, tablet). Each device has its own PIN or passphrase to add an extra layer of security. The user needs approval from a set number of devices (m-of-n) to finalize a transaction, offering a simpler form of Multi-Sig.

Blockchain Support for Multi-Sig Wallets

Bitcoin

The Bitcoin blockchain natively supports multi-sig addresses and security at the platform level. Its scripting language allows for seamless multi-key transactions, ensuring secure Multi-Sig operations.

Ethereum

The Ethereum blockchain, on the other hand, is account-based and limits private key usage to a single key for basic ETH transactions. However, through smart contracts, Ethereum can support Multi-Sig by allowing multiple private keys to interact within the contract.

Drawbacks & Challenges of Multi-Sig

While Multi-Sig wallets offer increased security, they come with challenges. Managing multiple private keys or devices with the same key but different PINs can become a significant burden. The risk of losing one or more keys grows as the number of keys increases, and this expanded scope of security management can complicate things. Furthermore, defining thresholds carefully is essential—using n-of-n instead of m-of-n means that all keys or devices must be available to authorize a transaction, which can introduce critical points of failure.

Conclusion

Multi-Sig wallets offer a robust security solution for institutional and retail investors alike. However, they require careful configuration and management. A thorough understanding of how Multi-Sig works, along with secure storage and usage practices, is essential to ensure the safety of your crypto assets.

This article was written by our CryptoCurrency Essentials (CCE) Committee, with special thanks to committee member Taher Borsad.

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

Expanding Excellence: C4 Exams Transition to New and Improved Testing Platform

A Unified, Enhanced Testing Experience

This transition not only enhances the user experience but also aligns with our commitment to maintaining the highest standards in cryptocurrency education and certification. The new and improved testing platform offers a seamless, intuitive user interface and provides valuable insights into test results, ensuring that every candidate experiences an efficient and comprehensive testing process. With these upgrades, candidates for the CBP (español), CEP and CCSSA certifications will enjoy the benefits of real-time scoring, instant feedback, and a flexible schedule for taking the exams online.

Updated Pricing Structure

In our ongoing effort to deliver exceptional value and quality, we've updated our exam and certification pricing. The revised fees will include the initial exam cost, one retake (if needed), as well as a digital certificate. Printed certificates will continue to be available for a nominal shipping fee.

Users who have already paid the exam fee with C4 may contact certifications@cryptoconsortium.org for assistance.

How to Proceed

To register for the CEP, CCSSA, or any other C4 exam, or to renew your certification, please visit our website. https://cryptoconsortium.org/get-certified/

Conclusion

C4's commitment to fostering professional growth and enhancing security practices within the cryptocurrency space continues with these exciting updates. Whether you are a new candidate aiming to certify your expertise or a returning professional seeking to renew and refresh your knowledge, our new platform and its features are here to support your journey in the cryptocurrency world.

If you have any questions or concerns, please contact us at certifications@cryptoconsortium.org.

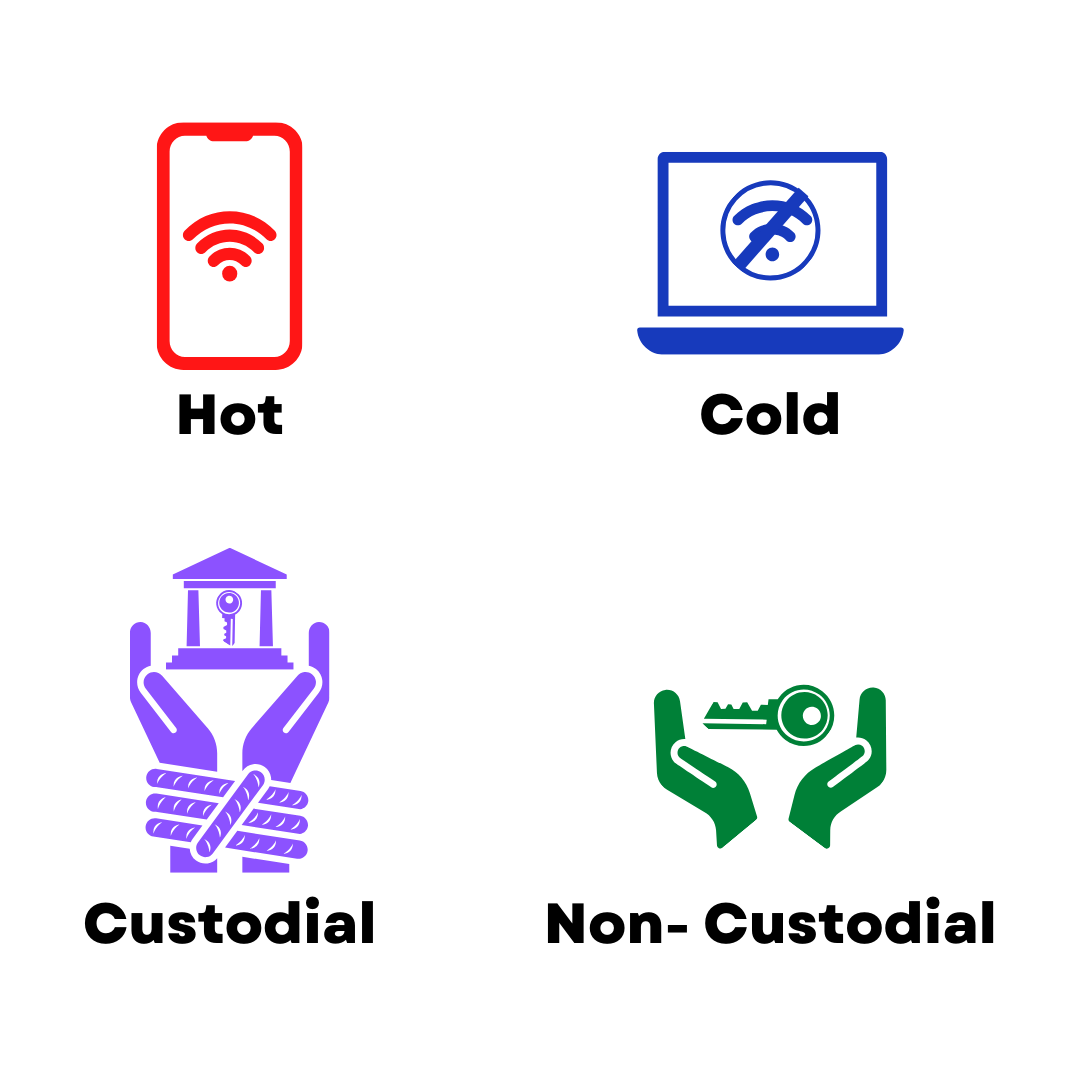

Overview

Self-Custody cryptocurrency wallets, otherwise known as noncustodial wallets, represent the heart of decentralized blockchains - self sovereignty! With a noncustodial wallet, users hold their own keys to their money, retaining full control over their transactions, security, and privacy. Self-custody wallets allow for maximum control, but they also require a user to fully create and understand their own security posture. Let's discuss some of the pros and cons of self-custody wallets, how to choose one, and basic security tips.

Pros and Cons of Non-Custodial Wallets

There’s a classic saying in the crypto world: “Not your keys, not your coins.”The biggest pro of self custody is full control and self sovereignty. With these wallets, the users hold their own keys, giving them full access to their coins or tokens without having to rely on a third party. With this model, there's no counterparty risk - meaning there's no third party you have to trust to hold or secure your money. You are solely responsible for handling your keys securely. There's no ability for anyone else to lock you out of your funds or lock you into a particular wallet - you can transfer your keys to any software that supports standard private keys and seed phrases.

Self-Custody wallets are the most accessible to anyone, anywhere in the world. All a user needs is a phone or PC and an internet connection to download wallet software. There's no requirement for ID, a bank account, or even a permanent address to use a cryptocurrency wallet. There's also software for every need, ability, and threat model - from very easy-to-use wallets to feature rich "power user" software for the tech-savvy and perhaps paranoid!

However, there are some cons to this model of full private-key control. With noncustodial wallets, again, you are fully responsible for your money. While that provides autonomy, it also means you are solely responsible for ensuring the security of your keys. If you make mistakes in storage, or accidentally reveal your keys to an attacker, your coins will be lost. There's no support team or helpdesk to reach out to or chargeback mechanism on the blockchain. It's critical for users to understand security best-practices and implement them for their own needs.

Choosing a Self-Custody Wallet

Self-custody wallets come in several forms, most often sorted by the device you run the software on. In general, there's three major types of noncustodial wallets:

- Desktop/Web Wallets

- Mobile Wallets

- Hardware Wallets

First, desktop and web wallets. An example of a web wallet would be the MetaMask wallet. These wallets are generally the least secure of the 3 classes, due to the highest attack surface. With web wallets especially, there's a wide variety of methods attackers can use to compromise them, such as fake-but-convincing websites that pretend to be your wallet (phishing), Javascript/web application vulnerabilities, and the like. Web wallets are not advised.

Desktop wallets such as Electrum can be slightly more secure, but suffer from similar potential problems. Malware that steals key files can take a copy of your wallet, and address-swapping malware (address poisoning) attacks can replace copy-pasted addresses you use for transactions with that of an attacker. All of this is not to scare you, but advise that desktop and web wallets have a higher degree of risk than other types. They can be used safely, but require vigilance and a well-secured device.

A better option for an easy-to-use wallet would be a mobile wallet, an app installed on a smartphone. Mobile wallets are often designed to be user friendly, and offer quick access to your coins for everyday transactions. Mobile operating systems are more "locked down" than desktops. Although not invulnerable, they are less likely to suffer from problems with malware as users only install software from app stores, where applications are vetted for malicious code. Mobile wallets, like desktop and web wallets, store an encrypted copy of the keys on the device, so make sure to choose a strong wallet passphrase.

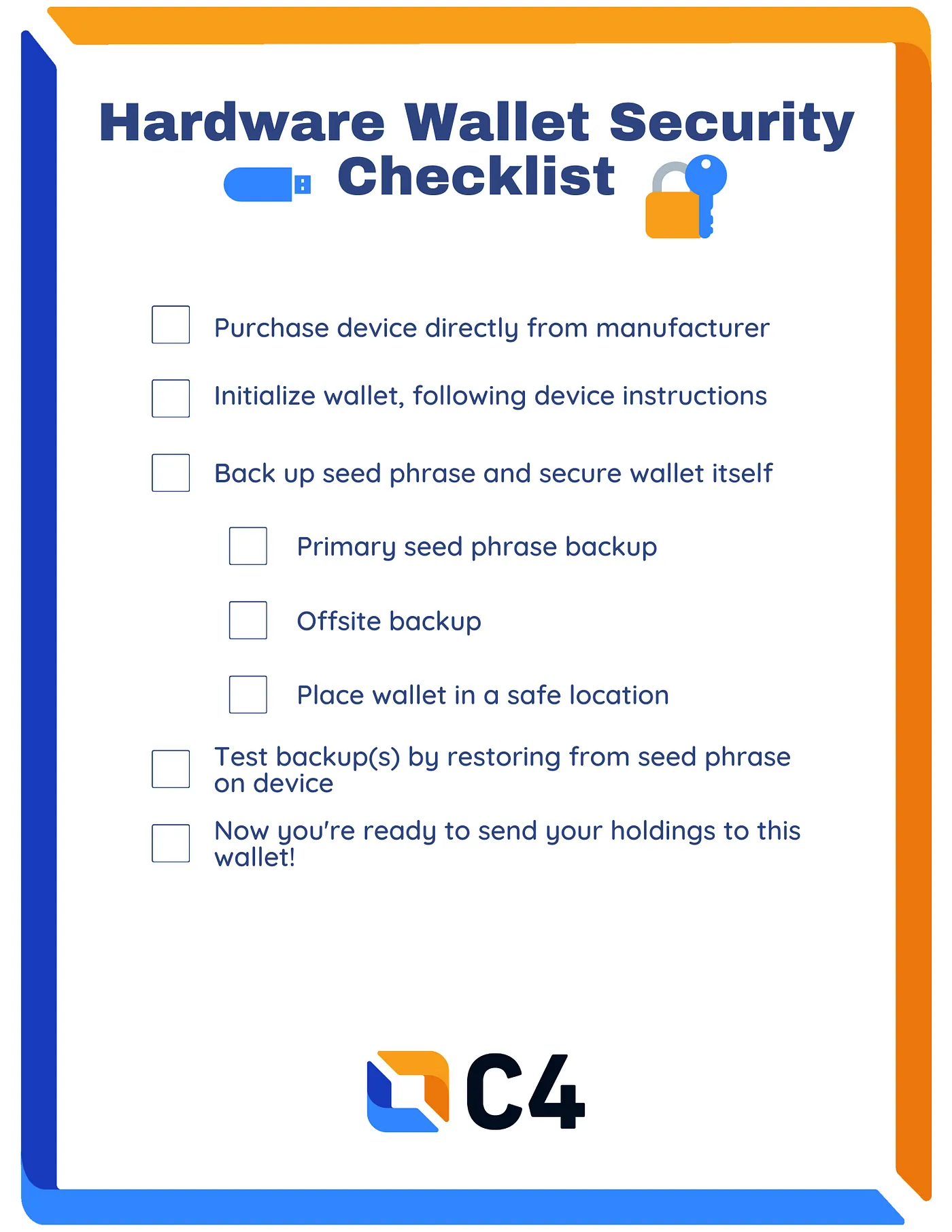

The third and most secure type of self-custody wallet is a hardware wallet. These include wallets like Trezor, Ledger, or KeepKey. These are specialized devices designed to do one thing - generate and store cryptocurrency keys securely and use those keys to sign transactions. They don't run any other software or even connect to the internet. This type of wallet has the smallest attack surface, and therefore fewer chances for an attacker to compromise your keys. These do cost more money than desktop or mobile wallets, which are usually free. A hardware wallet will often cost around $50 USD, which may be expensive for users new to cryptocurrency.

Seed Phrase Basics

Almost all modern wallets, whether desktop, mobile, or hardware, will give the user a seed phrase. This phrase of 12-24 random English (or local language) words encodes all of the user's private keys in a simple format. The seed is used to access all of the cryptocurrency in that wallet, so it is critical to safeguard this phrase.

For a desktop or mobile wallet, it is okay to store an encrypted form of that seed in software such as a password manager, protected by a long strong passphrase. However, there are some risks associated with doing so. It's preferred to write down a seed phrase on paper or metal, and store that in a safe location.

For a hardware wallet, you must only write that seed on paper or metal, and never type it into any general-purpose computer like a phone or PC even if it's encrypted. The security model of a hardware wallet is to generate and store keys offline - so doing this basically turns a hardware wallet into a normal desktop or mobile wallet. Your security is no longer that of an offline hardware wallet, it's only as good as that phone or PC you're storing a copy of the seed on! It doesn't mean your money will be instantly stolen, but you'll have less security than you think you do.

No matter what type of wallet, never store a copy of the seed in plain-text form on a computer. Do not type your seed into a Google Doc, a .txt file, or even take a picture of it with your phone. Malware and other sophisticated attacks can search your PC for this information if it is compromised, and use the seed to steal all of your coins. Also, make sure that no matter how you store your seed you make backups. If on paper, place a copy in another safe location so that fire or flood does not completely destroy the keys. If stored in encrypted form, make sure there's backups of that vault. Losing your seed means losing your coins, so it's critical you always have access to that information.

Self Custody Sovereignty

Self-custody wallets give users the best of cryptocurrency - full control! You can use your coins any time, anywhere in the world without relying on third parties. No ID, no KYC, no lockouts or inconveniences of traditional banking. But with this power does come additional responsibilities. You are fully responsible for the security of your coins. Make sure to choose a secure, well vetted wallet that fits your needs. For small amounts of spending money, a mobile wallet is the best choice. For larger amounts or long-term storage, a hardware wallet will offer additional security. In either case, secure storage of the seed phrase is important. Make sure your seed phrase is stored somewhere safe on paper or metal, and make and store safe backups. Make sure you don't lose that seed phrase; keep yourself safe and sovereign with your coins!

This article was written by our CryptoCurrency Essentials (CCE) Committee, with special thanks to committee member Josh McIntyre.

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

Overview

In the rapidly evolving world of cryptocurrency, the sanctity of one's crypto assets is paramount. As digital thieves become more sophisticated, so must our defense mechanisms. One of the primary tools at our disposal to fortify our accounts against unauthorized access is Multi-Factor Authentication (MFA). This blog explores what MFA is, the types of authentication factors involved, and crucial steps to ensure you utilize MFA optimally for your crypto exchange account.

What is Multifactor Authentication?

At its core, MFA is a security process that requires an additional step for verification instead of relying solely on a password. MFA adds additional layers of security, thereby drastically reducing the chances of unauthorized access.

Imagine a high-security facility. Instead of just one lock on a door, the user might have to have a key and swipe a badge to open the door. Similarly, with MFA, even if a cyber-thief manages to get past one layer (e.g., knows your password), they still have more hurdles to clear before accessing your account.

Types of Authentication Factors

Authentication factors for MFA can generally be categorized into:

- Something you know: This is the traditional password or PIN. It's something that you've memorized and can recall upon request.

- Something you have: This refers to a physical device in your possession, such as a security token, a smart card, or even your smartphone where you might receive a one-time code via SMS or through an authenticator app.

- Something you are: These are biometric methods of identification such as fingerprint scans, retina scans, or facial recognition.

For crypto exchanges, a common combination involves using a password (something you know) and then a code generated by an authenticator app or received via SMS (something you have).

Turn MFA On ASAP!

Given the value and volatility of crypto assets, it is crucial to turn on MFA for your crypto exchange account immediately if you haven’t already. While it might seem like an extra step during login, the benefits in terms of account security are immense. Without MFA, if someone manages to get a hold of your password, they have instant access to your funds. With MFA, that password alone is useless to them.

Backup Your MFA Codes

Most platforms, when setting up MFA, will provide you with backup codes. These are crucial. If for some reason, you lose access to your primary MFA device (e.g., you lose your phone), these backup codes will be your ticket back into your account.

- Store them securely: These codes are as important as your password. Print them out and store them in a safe place, away from prying eyes.

- Avoid digital copies: It's tempting to screenshot or save these codes in your email. However, if your email gets compromised, these backup codes can be a goldmine for hackers.

- You can instead store these securely in a password manager. Keep in mind though that doing so means your accounts may still be compromised in the event your password manager is hacked. You may wish to store your 2FA codes separately or ensure your password manager is also protected by 2FA.

Securing Your MFA Codes

- Securely Store Backup Codes: Treat MFA backup codes with the same level of care as you would a password. Keep them in a safe and separate location, away from your primary device. Consider using a physical safe or a secure digital storage option like a password manager.

What Not to Do:

- Avoid Storing Backup Codes on Your Primary Device: It's essential to refrain from saving backup codes on the same device you use for MFA. Losing your device means losing access to your backup codes as well.

- Limit Access to Backup Codes: Share backup codes sparingly, if at all. They should be reserved for emergencies, preferably for your use only. Avoid placing them in easily accessible locations like your wallet or on sticky notes.

Good habits:

- Regularly Review and Replace Backup Codes: Be proactive and periodically review your backup codes. Make sure you have a sufficient supply of unused codes. If you're running low, generate a fresh set.

- Enable Account Recovery Options: Take advantage of account recovery options provided by some services. These options often involve setting up a secondary email address or phone number. Ensure that these recovery options are up-to-date.

- Test Backup Codes: Before you actually need them, verify the functionality of your backup codes. This way, you can be confident they will work when required.

- Understand Expiry Dates: Keep an eye out for any expiry dates on backup codes set by platforms for security reasons. Replace any expired codes as necessary.

- Generate New Codes if Compromised: If you suspect that your backup codes have been compromised, generate a new set immediately. Treat this process like changing a potentially exposed password.

- Regularly Review MFA Settings: Periodically check your MFA settings on each platform to ensure correct configuration. Make any necessary updates or changes.

- Consider Using Hardware Tokens: Instead of relying solely on backup codes, consider the use of physical hardware tokens for MFA. These convenient devices generate one-time codes and enhance security.

Summary

In a realm as dynamic and promising as cryptocurrency, security is paramount. Multi-Factor Authentication offers an invaluable layer of protection for your crypto exchange account, shielding your investments from potential unauthorized access. Major exchanges such as Coinbase support strong 2FA like auth app and security keys, so take advantage of that for better security. By understanding its importance, enabling it promptly, and ensuring that backup codes are securely stored, you make a significant stride towards safe and worry-free crypto trading. Don't wait – secure your crypto future with MFA today!

This article was written by our CryptoCurrency Essentials (CCE) Committee, with special thanks to committee member Manan Vora.

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

Introduction

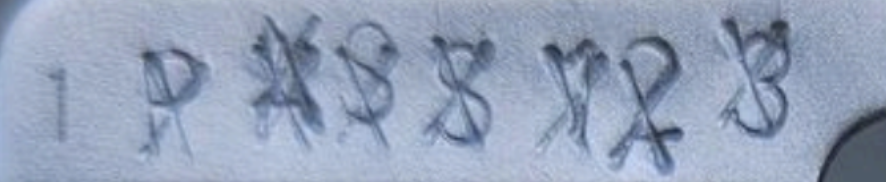

The CryptoCurrency Security Standard requires a Data Sanitization Policy as part of the 2.02 Data Sanitization Policy Aspect of CCSS. This aspect involves the elimination of cryptographic keys, seed phrases, and any sensitive information related to key management. Thorough sanitization guarantees the complete destruction of all sensitive information, thereby preventing any potential for data breaches from devices that are no longer in use. These devices include steel plates used for recording seed phrases.

One of the methods for recording seed phrases or passphrases long-term is to punch the 12-24 words from a mnemonic phrase onto steel plates. Steel plates are a popular method because they are not susceptible to electromagnetic attacks, fire (temperature-dependent on metal type), flooding, and are also resistant to other disaster scenarios. Steel plates are more resilient than storing secrets on paper, and less risky, in terms of data degradation and accidental data loss, than storing them on digital media.

However, this begs the questions: How might one go about sanitizing secrets that have been stored on a steel plate? Sanitizing data in accordance with CCSS requirement 2.02.2.1 requires that sanitized media conforms to the National Institute for Standards and Technology (NIST) Special Publications 800-88 recommendation to “clear, purge, or destroy” the media.

As a CCSSA, I have previously completed a CCSS audit and I am part of C4’s CCSS Advocacy Group. As a security advocate, I set out to determine what constitutes ‘cleared’ data for steel plates. Clearing the data is the most realistic method of data sanitization of a metal plate as most will not have access to a furnace that can reach the temperature required to melt metal.

The following walks you, the reader, through this process.

The question I am seeking to answer is:

After you punch your seed phrase or secret onto a steel plate, how effective is it to overwrite that data using this ‘Clear’ method of sanitization? Can the secret be recovered after performing the ‘Clear’ method of overwriting data?

Follow along to see!

The Set-Up

To test the ‘clearing’ of a steel plate, first I purchased a set of steel plates and punches.

To start the experiment I punched the secret ‘PASS123’ into the first cell on the steel plate. This is being used in lieu of a secret seed phrase and will be the data punch and then destroy in each of these attempt. For each type of data destruction I will punch the seed phrase in the same manner and then attempt to destroy the data using different methods.

The Experiment

In this section, I will use a myriad of different “common” hand tools to test their effectiveness and efficiency for sufficiently wiping data punched into steel plates. The purpose of this continued experimentation is to try and find a more time efficient way to destroy the secret punched into the steel plate. I’m going to use the same secret as the above example for each of the tools demonstrated below.

Letter Punch

To keep this simple, I will overwrite the secret with a series of letters and numbers and then check if "three passes," as mentioned in the NIST 800-88 specification, will be sufficient to make the secret unreadable and unrecoverable.

On my first pass to overwrite the data I used the same lettered punches that I used to embed the secret, using an 'X' punch. You can still clearly see the secret.

On my second pass to overwrite the data, a 'W' punch was used.

Some of the secret is still visible: The ‘P', the ‘S’s, and ‘2’ and '3’.

On the third pass, I used a number '8' punch.

We can see after the third pass most of the secret is no longer readable, although I can still kind of make out the '2'. If this was a real secret, another pass with another punch would be a good idea to further destroy the original secret and make it unrecoverable.

Using additional punches to overwrite the secret data punched into steel plates until it is no longer readable/recoverable, does seem to be possible to effectively make a secret punched into steel plates unrecoverable using the ‘Clear’ method of data sanitization from the NIST 800-88 standard.

For this method, I would recommend performing at least 3 passes of overwriting the secret data to make it unrecoverable. Perform more passes if the secret is still visible / recoverable.

I would also recommend using punches that cover the top and bottom of the data being overwritten, as to not reveal any information about the individual characters in the secret.

Also, be aggressive with the punches while overwriting data. Give a good punch, not a tap, to better overwrite the data. This applies to any punch method.

There are no additional tools required for overwriting the data in this manner. A potential downside to this approach is that it takes at least 3x longer to sanitize the secret than it took to initially record the secret as the data had to be overwritten 3 times, and to be most effective further overwriting would be advised. It is pretty tedious to overwrite the data character by character as the above example demonstrated.

Summary

Effectiveness: 10 (Highest)

Cost: 3

Effort: 8

Chisel

For this experiment, I used a chisel, which is a wedge shaped metal punch tool, to overwrite the secret. I did not count the number of passes, rather made enough punches for the secret to be overwritten.

This tool is pretty effective at destroying the secret data. I can still make out some of the letters such as ‘A' the ‘2’ and '3’. My chisel was used and the tip was more dull, so a sharp tip (or a new chisel) would likely perform better. The time it took was very short, about a 1 minute or <10 strikes to get the result shown below.

The cost of a set of chisels on Amazon is around $20 and would likely last for as many steel plates as you can destroy. The plate is softer metal so I can't imagine the chisels getting dulled at all from this task.

Summary

Effectiveness: 5

Cost: 3

Effort: 2

Round Tip Punch

I used a round tip punch. Again, I did not count passes, but rather made enough punches for the secret to be overwritten.

Using a round tip punch to overwrite the secret required more work than the chisel but not as much as overwriting it letter by letter. Some of these letters are still visible such as the ‘A' and the 'S’s.

I thought this tool would smush the letters and they would be so mangled they’d be unreadable. I think the effectiveness will depend on how prominent the original secret was punched into the steel.

Summary

Effectiveness: 4

Cost: 4

Effort: 5

Electric Powered Grinder

An electric powered grinder was the ultimate tool to wipe data punched in a steel plate.

The time and effort are the lowest with this tool. As shown in the photo below, I intentionally left some of the letters, but the area that was ground away leaves nothing to recover. Doing this took about 3 seconds, so the time to effectively destroy the secret is minimal.

Summary

Effectiveness: 10

Cost: 5

Effort: 1

Conclusion

In conclusion, the CCSS 2.02 Data Sanitization Policy highlights the critical need for effective methods of data destruction, including when it comes to durable and resilient mediums like steel plates. The exploratory work of CCSSA William Keppler, as detailed in this article, underscores the practical challenges and potential solutions in achieving complete data sanitization.

By experimenting with various tools and methods, from manual punches to electric grinders, Keppler has demonstrated that while traditional overwriting methods can be effective to a certain degree, more aggressive techniques such as grinding offer a far more reliable solution for ensuring that sensitive information is irrecoverable. This aligns closely with the recommendations of NIST SP 800-88, which advocates for a comprehensive approach to clearing, purging, or destroying data. For entities dealing with highly sensitive information, adhering to these stringent standards is a critical component of operational security.

This article was written by Will Keppler, Halborn.

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

Overview

Passwords. Everyone in the digital world has to use them, generate them, store them, remember them, and ensure they are secure. However, picking good passwords is hard, and there are many common pitfalls in the secure use of passwords. Some platforms are moving towards a passwordless future, where applications use other means of authentication - MFA apps, hardware security keys, and other methods. For the most part though, services still use passwords, and it's critical that users manage them securely. Preventing account compromise, in most cases, starts with password management.

Password Management Tips

Password Picking

Setting up a solid password involves multiple factors, but the core technical factor needed is entropy, or randomness. In simple terms, the more random a password is, the better.

Randomness makes it difficult for an attacker to guess your password. Hackers might try to guess your password right on a website, entering it into the password field directly. More likely though, they have a password hash from a data breach - a scrambled version of the password run through a cryptographically secure one-way function. They must try to guess your password until they get a matching hash, and can then use that password to log into your accounts.

But how random is random? You might think that something "goofy" is random enough. The password "sillypotato", for example. But in terms of real entropy, 2 silly words isn't really that random. An attacker with a powerful computer could guess this simple 11 character, 2 word password in seconds to minutes. It turns out humans are really bad at random generation on our own.

A better way to create secure passwords is to use tools like a password manager to generate truly random passwords, consisting of random characters selected by the computer's cryptographically-secure RNG. A truly random 20-character password might look like this - "u8XqHp6jVp7eFutm9nzz". If you have to type or easily remember a password, you can use a type of random generation called diceware, which turns the underlying entropy into a series of English (or some other language's) words. For example - "PokeParkLikeQuickHappy". This diceware phrase is generated from 13 bits of entropy per word, and ends up with 22 characters. Lastly, if you must generate the password yourself, choose a long phrase over one or two words. Generating a long sentence with meaning to you is better, for example - "HarryPotterAndTheLongStrongAccountPassphrase" is better than "HarryPotter".

You'll notice that these random passwords aren't only random, it's also longer than our example "sillypotato" password. Length is another important component of strong passwords, and ties in with the concept of entropy. The longer a password is, the more possible combinations exist. With every character added to a password, the amount of possible passwords an attacker has to guess increases exponentially. Practically speaking, an attacker with an off-the-shelf laptop can guess all possible 8 character passwords in minutes. It doesn't matter how random an 8 character password you use, because an attacker can guess all of the possible combinations quickly.

Password Management

There's another layer to password security, not just the strength of one individual password. Password reuse is a danger that must be avoided. We discussed the possibility of an attacker guessing a password via password cracking methods. And if you reuse that password across multiple services (Coinbase, Google, Facebook, Banking, etc.), the attacker has now compromised all of those services. It's critical to generate unique, strong passphrases for all the different accounts you use. So if one is compromised, the others can remain safe.

Generating strong, random passphrases may be important for security against attacks, but also come with a practical cost. How does one remember all these difficult to guess passwords? It is completely impractical, if not impossible, for a person to remember hundreds of passwords for different accounts.

In comes a piece of secure software called a password manager. Password managers are bits of software designed specifically to generate, store, and even autofill secrets - your passwords! The software encrypts all of your passwords, 2FA notes, or payment cards in a secure vault using the master passphrase as the encryption key. Users only have to remember one very long, strong, random master passphrase to decrypt the secrets stored in the manager. To access your other accounts, the manager can autofill websites' login fields or allow you to copy-paste your passwords.

Password managers are particularly useful because they prevent password reuse, and allow you to generate and store much stronger passphrases than you can remember on your own. It's critical that you choose a well-vetted, reputable password manager and generate a long, strong master passphrase for encryption.

Password Power

There's a lot that goes into day-to-day password security. The two most critical components for the average user are the strength of their passwords - in other words, their resistance to password cracking attacks. Strength comes through overall entropy - the amount of randomness and length of the password. Choose long passwords, 20+ characters or more, and randomly generate those passwords if you can. If a password must be memorable, diceware is a useful tool. If it must be self generated, make your passphrase a long sentence of words rather than one or two words.

Secondly, password management must consider password reuse and avoid it as much as possible. A secure password manager can help you by generating, storing, and autofilling each unique password for various services. It's important to choose a long, strong, random master passphrase to encrypt your password manager vault.

Password hygiene is a challenge, but understanding these basic tips will help clean up your password game and build your security skills!

This article was written by our CryptoCurrency Essentials (CCE) Committee, with special thanks to committee member Josh McIntyre.

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

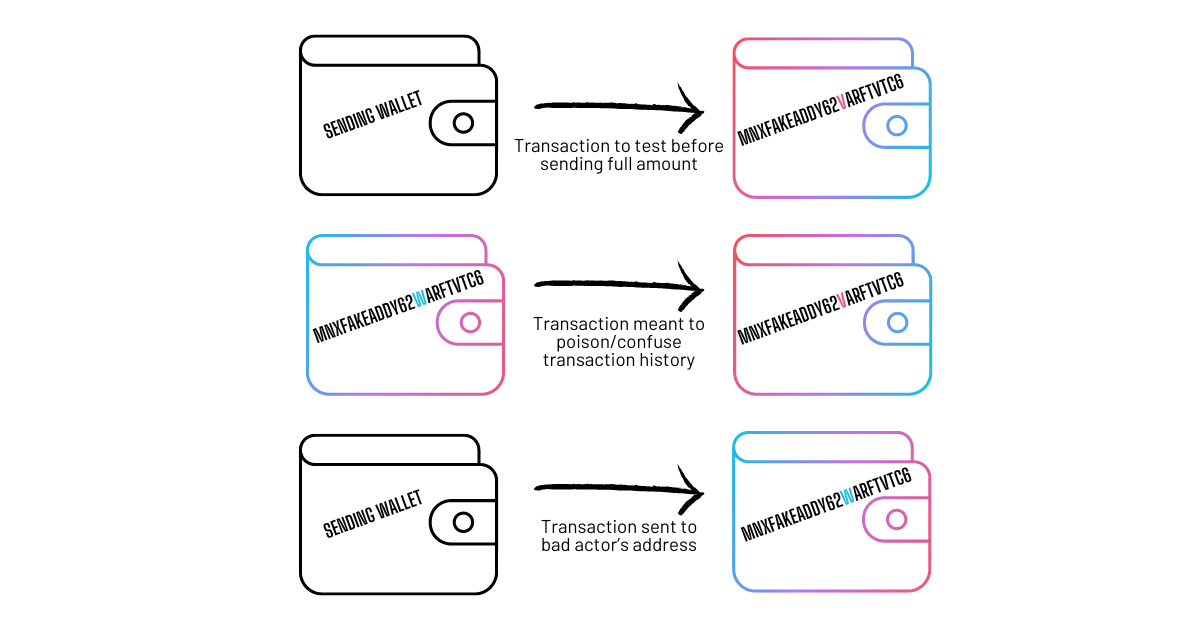

Navigating the Risks of Address Poisoning: A Growing Scam in the Crypto World

In the ever-evolving landscape of cryptocurrency, where innovation and technology leapfrog at a rapid pace, so do the strategies of scammers. One such emerging and insidious tactic is the 'Address Poisoning Scam.' This blog aims to shed light on what address poisoning is, how it works, and, most importantly, how you can protect yourself from falling victim to this cunning scam.

What is Address Poisoning?

In May 2024, the DEA lost $55,000 in an Address Poisoning scam. Address poisoning is a relatively new type of scam in the crypto world. It exploits a key feature of cryptocurrencies - the public visibility of transactions on the blockchain. Scammers target the public transaction history of users, inserting their own wallet addresses that closely resemble those of legitimate users. This subtle manipulation can easily go unnoticed but can lead to significant losses for unsuspecting victims.

How Does Address Poisoning Work?

The scam operates on the premise of human error. Most crypto users rely on copy-pasting wallet addresses when making transactions. Address poisoning takes advantage of this by 'poisoning' the transaction history with similar-looking addresses. When a user copy-pastes an address for a new transaction, they might accidentally choose the scammer's address instead of their own. Once the crypto is sent to this address, it's nearly impossible to recover.

The Role of Vanity Addresses:

Vanity addresses, which contain recognizable words or patterns, can make the scam more effective. These specially crafted addresses are more memorable and can easily be confused with a user’s actual address, making the scam harder to spot.

How to Protect Yourself:

- Double-check Addresses: Always verify every character of the wallet address before confirming a transaction. This simple step can be your first line of defense.

- Use Address Book Features: Many wallets offer the option to save and label frequently used addresses. Utilize this feature to minimize the risk of selecting a poisoned address.

- Be Cautious with Transaction Histories: Be aware that transaction histories can contain these poisoned addresses. Relying solely on them for address information is risky.

- Educate Yourself: Stay informed about the latest scams in the crypto space. Awareness is a powerful tool in combating these threats.

- Use Hardware Wallets: For added security, consider using a hardware wallet, which reduces the risk of falling for such digital traps.

Address poisoning is a stark reminder that in the digital age, even the most minor details require our attention. In the world of cryptocurrency, where transactions are irreversible, the importance of vigilance cannot be overstated. By educating ourselves and adopting cautious practices, we can stay one step ahead of scammers and protect our digital assets.

Stay Safe and Informed:

Remember, the crypto journey is as much about staying secure as it is about exploring new financial frontiers. Stay safe, stay informed, and let's continue to navigate the dynamic world of cryptocurrency with confidence and caution.

This article was written by our CryptoCurrency Essentials (CCE) Committee, with special thanks to committee member Manan Vora.

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

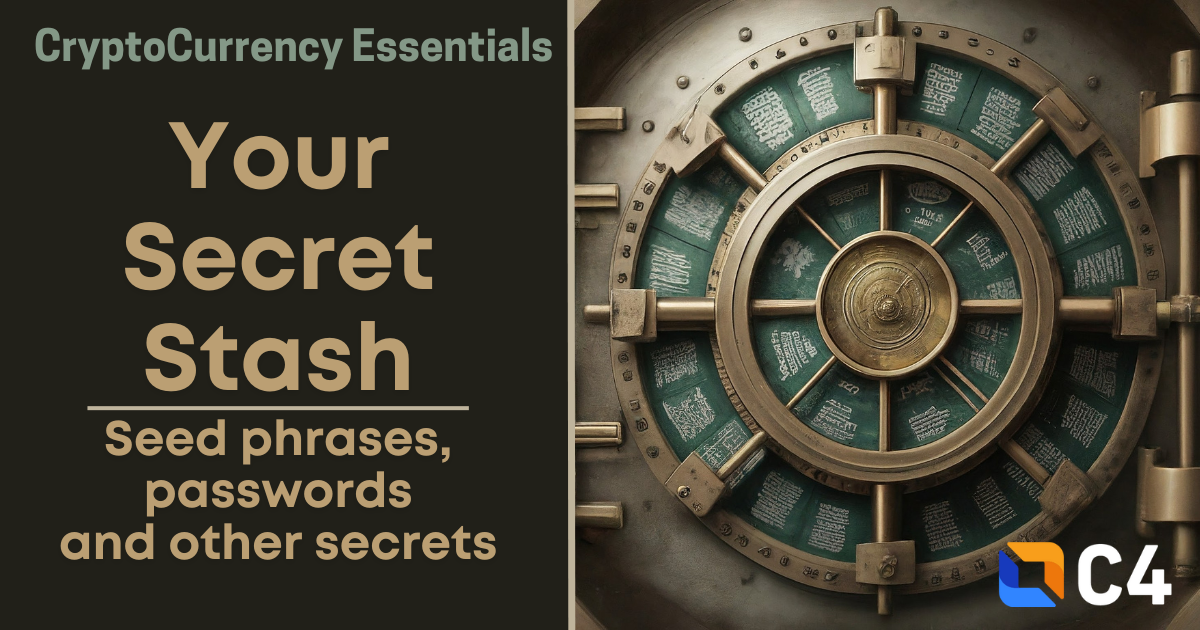

Your Secret Stash: Seed Phrases, Password Managers, and Secret Hygiene

Overview

Storing a backup of your cryptocurrency seed phrase is a crucial security practice. Every user needs a seed backup in the event the original wallet software, device, or keystore is lost. However, there are often questions as to where to store that seed phrase safely. Users may be curious about store seed phrases on paper, metal, or in an encrypted form such as a secure password manager. Depending on the type of wallet, where you put your backup may reduce or compromise your security. As such, it's important to understand the relationship between the type of wallet (hot or cold) you are using and appropriate backup procedures.

First, A Note on Password Managers

A password manager is specialized software designed for storing, generating, and even auto-filling passwords. This software is designed with the secure storage of secrets such as passwords in mind. A password manager's user must only remember one very long, strong passphrase known as a master passphrase. This phrase is used to encrypt all of the passwords and other secrets stored in the password manager vault.

A password manager is an excellent security tool, as it allows users to store much stronger passphrases than they can remember for all their different accounts. Passphrases can be randomly generated strings or even random diceware passwords consisting of words. These phrases are longer and stronger than typical passwords and thus, less susceptible to attack. If a user's password hash is leaked from a company's database, it's less likely an attacker will crack that strong passphrase and take over the account.

A password manager also helps prevent password reuse. Since the user only has to remember their master passphrase, the password manager can store a unique passphrase for each account. If one account's password is somehow compromised, this prevents an attacker from using the password to gain access to another account. For example, using a unique passphrase prevents a breach at your electric provider from being used to attack your Coinbase account.

Password managers can be used to store more than just passwords. Many allow you to secure credit card information, cryptographic keys, notes, 2 factor backup codes, or other key data such as seed phrases.

Seed Phrases and Password Managers

Since password managers are purpose-built for storing secrets, is it wise to store seed phrase backups in them? It's certainly a bad practice to store seed phrases in plaintext - such as a screenshot or Google/Word document. But password managers do encrypt the secrets stored within, so what about seed phrases? The answer, like many issues of security, is it depends.

Generally speaking, storing the seed phrase for a hot wallet in a password manager is reasonably secure. To understand why it's likely okay for most use cases, we should think about the concept of hot wallets and possible attack surface for those wallets. A hot wallet is a crypto wallet that generates and stores the keys on a general purpose computer - such as a laptop or phone. These wallets include apps like Coinomi or Exodus, Electrum desktop, or the Metamask browser extension.

The key here is that storing an encrypted seed phrase in a password manager offers roughly the same security level/attack surface as the wallet itself. The wallet already generates the keys on a general-purpose computer, and stores the keys encrypted on that device (protected by a PIN, password, or other mechanism). If you store a copy of the seed in an encrypted password manager, you're also encrypting the keys on a general-purpose computer. In either case, a theoretical attack includes malware or some other exploit allowing an attacker to access the encrypted keys. If they can guess the password to the encrypted vault using password cracking techniques, they can ultimately steal the coins.

The security of your funds with a hot wallet really lies in the quality of the master passphrase for the wallet or password manager in most cases, so it's critical to choose a very strong, random master passphrase for your vaults.

But what about cold wallet seed phrases? Should you store the seed for your Trezor, Ledger, or other hardware device in a password manager? The answer is no, you should never store the seed for an offline wallet in a password manager.

Why is this recommendation different from that of a hot wallet? Again, the answer lies in the security level and attack surface the wallet is designed to have. The whole purpose of a hardware wallet/cold storage is that the keys are generated and stored offline, on a single-purpose computing device. A hardware wallet is designed to keep your crypto keys away from malware and networks, where there are more opportunities for an attacker to steal them. A hardware wallet only stores crypto keys and signs transactions offline, and does nothing else. By putting your hardware wallet seed into a password manager, you reduce the level of security to that of a hot wallet. You're now only as secure as that PC or phone, and the passphrase protecting your manager vault. You don't have cold storage anymore, you've effectively turned your wallet into a hot wallet.

Password Manager Breaches and Crypto Theft

Recent news surrounding the 2022 LastPass data breach has brought forth questions about the security of storing seed phrases in password managers. Some users of LastPass affected by this breach have reported the theft of cryptocurrency where no other avenue of compromise seems likely. So how does an attacker steal crypto from a user in this case?

In this breach, the attackers gained access to the encrypted password vaults. The data stored inside (passwords, seed phrases, etc.) can only be unlocked with the proper key. The master passphrase for the vault is used to derive the encryption key. In order to gain access to the keys, the attacker has to use password cracking techniques to essentially guess the right password. With a copy of the encrypted password vault available, the thieves could use specialized software to guess many possible password combinations using common wordlists or other techniques.

The critical line of defense in this case is the strength of the master passphrase. A master passphrase for a password manager should always be as long and as random as possible. The use of a long, difficult to guess sentence can make it infeasible for password cracking software to find a correct match. Users with weak master passwords had those passwords guessed, and once they were found the attackers could decrypt the vault and simply use the seed phrases to take the crypto in that wallet.

Seeds and Storage

When thinking about backing up seed phrases using a password manager, one must evaluate the overall security profile of their wallet. If it's a hot wallet, it is likely okay to store a copy of the seed in a password manager for safekeeping since the security level is roughly the same. For a cold wallet, it is never appropriate to store the seed in a password manager. And regardless of whether or not you choose to store seeds in a password manager, you should choose a very long, random, strong master passphrase to protect the secrets in that vault.

This article was written by our CryptoCurrency Essentials (CCE) Committee, with special thanks to committee member Josh McIntyre.

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

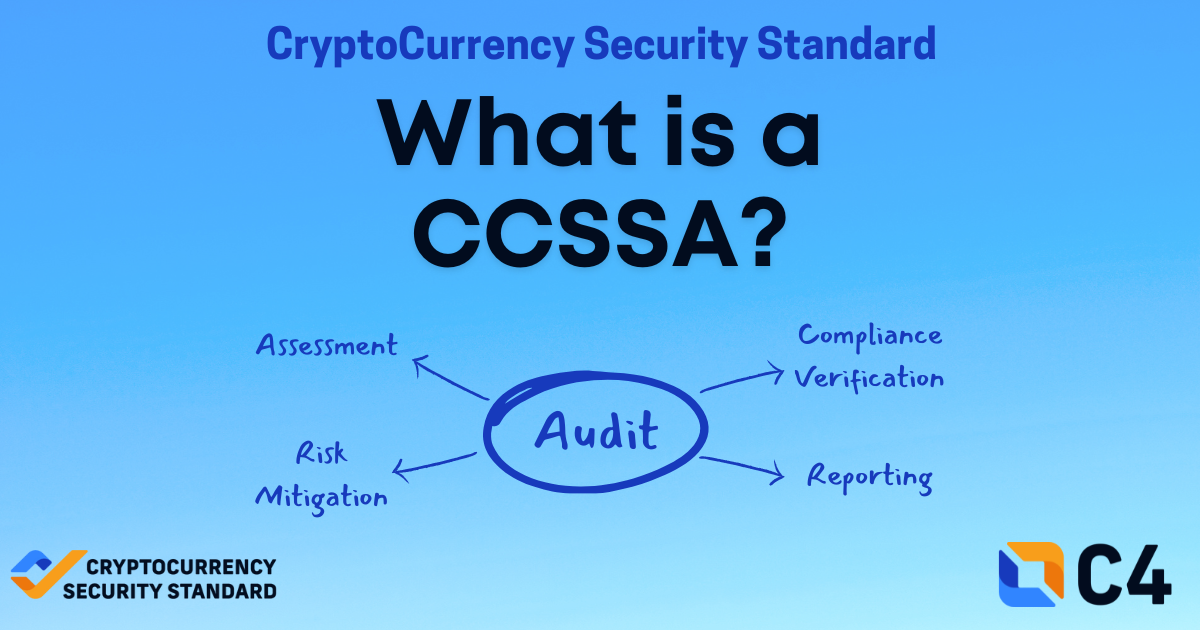

What Is a CryptoCurrency Security Standard Auditor (CCSSA)?

Where there are financial services, there's risk — and with the intricacies of digital assets, we need to work diligently to assess the security of these cryptocurrency systems. That's where CCSSAs come in, turning the tide against threats with their arsenal of security savvy and CCSS know-how.

The CryptoCurrency Security Standard, developed by the CryptoCurrency Certification Consortium (C4), outlines comprehensive security requirements for systems utilizing cryptocurrencies, including but not limited to exchanges, custodians and wallets.A CryptoCurrency Security Standard Auditor, also known as a CCSSA, is an individual proficient in evaluating and assessing compliance with the CryptoCurrency Security Standard (CCSS). CCSSAs are able to apply the CCSS standard to any information system that uses cryptocurrencies, calculating a grade for the system according to the CCSS.

CCSSAs have proven their professional working knowledge in all 31 aspect controls of the CryptoCurrency Security Standard (CCSS).

Key responsibilities of a CCSSA include:

- Assessment: Conducting thorough evaluations of information systems to ensure they meet the CCSS requirements.

- Compliance Verification: Verifying that crypto asset management systems, processes, and personnel align with CCSS guidelines.

- Risk Mitigation: Identifying and addressing potential security risks and vulnerabilities with a cryptocurrency infrastructure’s key management systems.

- Reporting: Providing detailed reports and recommendations for enhancing security posture based on CCSS assessments.

CCSSAs often have to assess information systems which may have novel or unique processes, and auditors have to consider compliance to the Standard in a holistic manner which takes into account the implementation details of the information system and its ability to achieve its intended outcomes.

Once hired by an entity, CCSSAs assess if the CCSS requirements have been met - meaning the scope is defined correctly, the required security controls are correctly implemented, working as intended, and meeting the CCSS requirements for that control.

All CCSS audits cover the 12 months prior to audit completion and will test the operating effectiveness of the control over this period of time. Audits are designed to be performed at least annually. All audits performed by CCSSAs are reviewed by a CCSSA-Peer Reviewer before C4 certifies an entity.

The entire CCSS audit process is carefully designed to increase the confidence of those utilizing cryptocurrency systems, and CCSSAs are bridging the gaps between this cutting-edge blockchain technology and ironclad security.

You can learn how to become a CCSSA here. If you’re interested in having your cryptocurrency system assessed and or audited, you can find a list of current CCSSAs here: Auditor's Table

If you’re not quite ready to make the leap toward an audit, you can take C4’s CCSS Level 1 requirements training course to learn more about what the audit process entails here: Master CCSS Level 1

If you’d like to see what systems have been audited, you can view completed audits here: Completed CCSS Audits

Or head over to cryptoconsortium.org to learn all about C4’s CryptoCurrency Security Standard!

Disclaimer

The information presented in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or any form of endorsement.

The views and opinions expressed by individuals in this article are solely those of the speakers and do not necessarily represent those of C4 or any other organizations with which they are affiliated.

The mention or inclusion of any individuals, companies, or specific cryptocurrency projects in this video should not be considered as an endorsement or promotion.

Regulations and legal frameworks around cryptocurrencies may vary in different jurisdictions. It is your responsibility to comply with the applicable laws and regulations of your country or region.

How is the Price of Bitcoin Determined?

The Economic Dynamics of Bitcoin’s Supply and Demand

The price of Bitcoin, like that of other cryptocurrencies, is determined by supply and demand in the market.

This means that its value fluctuates based on how many people want to buy Bitcoin versus how many are willing to sell it. Central to this is Bitcoin's supply cap of 21 million bitcoin. This finite supply plays a pivotal role in its long-term value proposition, as the dwindling new supply amid increasing demand can lead to price appreciation over time.

Using, holding, and being paid in Bitcoin are all activities that directly contribute to its demand and, consequently, its price fluctuations.

When individuals choose to use Bitcoin for transactions, it increases its utility and demand, as more people are recognizing its value as a medium of exchange. Basically it’s about embracing a financial system that's reshaping how we view value itself.

The essence of Bitcoin lies in its use. With each transaction, we're not just transferring value; we're pursuing a future where money moves freely and securely. Holding Bitcoin—often referred to as "HODLing" in the crypto community — isn't merely an investment strategy; it's a statement of confidence in Bitcoin’s revolutionary properties. When you're paid in Bitcoin, exchange fiat for bitcoin, or store bitcoin, you're part of a growing community that sees it as more than currency; it's a new standard for financial independence.

The underlying technology of Bitcoin, blockchain technology, is a decentralized ledger that records all transactions across a network of computers. This technology matters because it offers a level of security and transparency that traditional financial systems just can’t match.

Bitcoin is a world apart from conventional fiat currencies, untouched by government decree. Here, we're all participants in shaping the future of finance.

Bitcoin's journey toward becoming a universally accepted currency is far from complete. It faces challenges in scaling to meet global market demands, enhancing user interface designs for easier access, and developing privacy tools to protect users' financial privacy. Overcoming these hurdles is not just about technological advancements but also about fostering a culture of education. Sharing knowledge and educating both our peers and the next generation are crucial steps in ensuring the success of Bitcoin.

This is why our mission at C4 is not to speculate about price, but to educate about this revolutionary technology. We’re working to demystify Bitcoin, to peel back the layers of jargon and reveal the profound impact that finance with no borders promises.